All Categories

Featured

Table of Contents

Investments involve risk; Equitybee Securities, participant FINRA Accredited capitalists are one of the most certified capitalists in business. To qualify, you'll need to satisfy several needs in income, total assets, asset size, administration standing, or specialist experience. As an approved financier, you have access to extra complex and advanced kinds of safeties.

Enjoy accessibility to these alternative financial investment opportunities as an accredited financier. Check out on. Accredited investors commonly have an earnings of over $200,000 separately or $300,000 jointly with a spouse in each of the last 2 years. AssetsPrivate CreditMinimum InvestmentAs low as $500Target Holding PeriodAs short as 1 month Percent is an exclusive credit investment system.

Exclusive Exclusive Investment Platforms For Accredited Investors for Accredited Investors

To make, you simply need to register, purchase a note offering, and await its maturity. It's a terrific resource of passive earnings as you don't need to monitor it carefully and it has a brief holding duration. Great annual returns vary in between 15% and 24% for this possession class.

Potential for high returnsShort holding duration Capital in danger if the customer defaults AssetsContemporary ArtMinimum Financial investment$15,000 Target Holding Period3-10 Years Masterworks is a platform that securitizes leading art work for investments. It buys an artwork through auction, after that it signs up that property as an LLC. Beginning at $15,000, you can purchase this low-risk asset class.

Purchase when it's provided, and after that you receive pro-rated gains as soon as Masterworks offers the art work. Although the target duration is 3-10 years, when the art work reaches the wanted value, it can be marketed previously. On its website, the best gratitude of an artwork was a whopping 788.9%, and it was only held for 29 days.

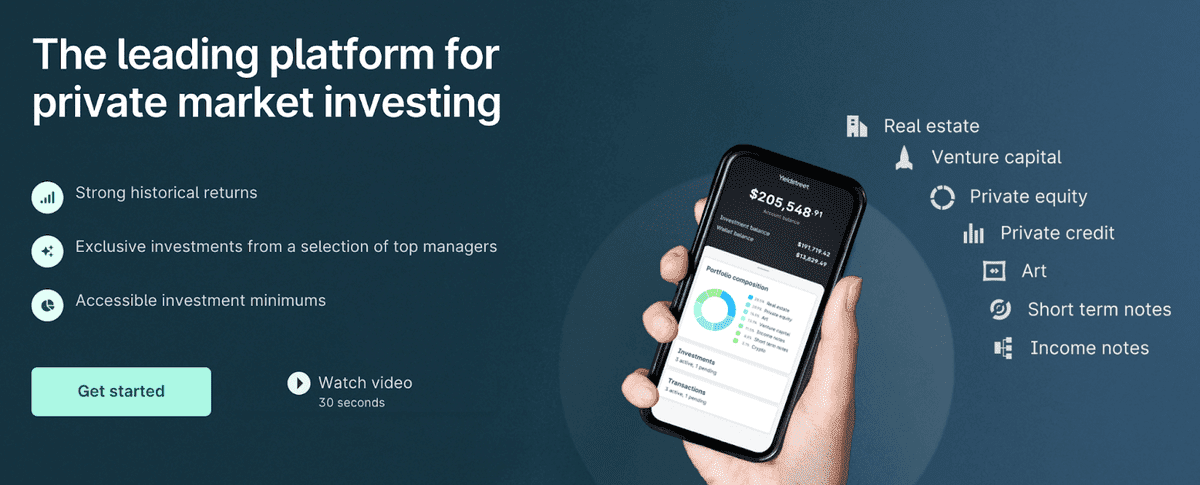

Yieldstreet has the broadest offering throughout alternative financial investment systems, so the quantity you can earn and its holding duration vary. There are items that you can hold for as brief as 3 months and as long as 5 years.

Specialist High Yield Investment Opportunities For Accredited Investors

It can either be paid to you monthly, quarterly, or once an occasion takes place. Among the downsides below is the lower yearly return rate contrasted to specialized systems. It supplies the very same items, some of its rivals exceed it. Its management fee typically varies from 1% - 4% each year.

In addition, it obtains lease revenue from the farmers during the holding duration. As an investor, you can earn in 2 means: Get dividends or money yield every December from the rent paid by occupant farmers.

Cost-Effective Accredited Investor Investment Opportunities

Farmland as an asset has historically reduced volatility, which makes this a terrific choice for risk-averse financiers. That being said, all investments still lug a specific level of risk.

Furthermore, there's a 5% charge upon the sale of the entire residential or commercial property. It spends in numerous bargains such as multifamily, self-storage, and commercial properties.

Taken care of fund by CrowdStreet Advisors, which instantly expands your investment across numerous residential or commercial properties. accredited investor real estate investment networks. When you purchase a CrowdStreet offering, you can obtain both a cash money return and pro-rated gains at the end of the holding period. The minimal financial investment can vary, however it typically begins at $25,000 for marketplace offerings and C-REIT

While some assets might return 88% in 0 (passive income for accredited investors).6 years, some possessions lose their value 100%. In the history of CrowdStreet, even more than 10 residential properties have adverse 100% returns.

Expert Accredited Investor Syndication Deals with Accredited Investor Support

While you will not get ownership here, you can potentially obtain a share of the earnings once the startup effectively does a departure event, like an IPO or M&A. Lots of good business remain exclusive and, therefore, commonly unattainable to capitalists. At Equitybee, you can fund the supply options of employees at Stripe, Reddit, and Starlink.

The minimal investment is $10,000. This platform can potentially give you large returns, you can likewise shed your entire cash if the start-up falls short.

When it's time to work out the choice throughout an IPO or M&A, they can profit from the possible boost of the share rate by having a contract that enables them to get it at a discount (accredited investor passive income programs). Accessibility Thousands Of Start-ups at Past Valuations Diversify Your Profile with High Growth Start-ups Purchase a Previously Hard To Reach Asset Course Based on availability

It can either be 3, 6, or 9 months long and has a set APY of 6% to 7.4%. Historically, this earnings fund has outshined the Yieldstreet Choice Income Fund (previously recognized as Yieldstreet Prism Fund) and PIMCO Earnings Fund.

Acclaimed Accredited Investor Investment Networks

Other attributes you can purchase consist of buying and holding shares of commercial spaces such as commercial and multifamily residential or commercial properties. Some users have complained concerning their absence of openness. Apparently, EquityMultiple does not connect losses immediately. And also, they no longer release the historic performance of each fund. Temporary note with high returns Absence of transparency Complex charges structure You can qualify as a certified investor making use of 2 requirements: monetary and professional capacities.

There's no "test" that grants an accreditor investor license. Among the most crucial points for an accredited investor is to protect their capital and grow it at the same time, so we selected possessions that can match such various threat appetites. Modern investing platforms, particularly those that offer alternative possessions, can be rather unforeseeable.

To make sure that certified capitalists will certainly have the ability to form an extensive and diverse portfolio, we chose systems that might meet each liquidity requirement from short-term to lasting holdings. There are different investment possibilities recognized capitalists can explore. Some are riskier than others, and it would depend on your risk hunger whether you would certainly go for it or not.

Accredited investors can diversify their investment portfolios by accessing a wider series of property classes and financial investment methods. This diversification can help minimize threat and boost their general profile performance (by staying clear of a high drawdown portion) by lowering the dependancy on any kind of single financial investment or market field. Accredited capitalists often have the possibility to connect and team up with other like-minded investors, market professionals, and business owners.

Table of Contents

Latest Posts

Back Taxes Homes For Sale

Taxsaleattorney Com Legit

Houses For Sale On Back Taxes

More

Latest Posts

Back Taxes Homes For Sale

Taxsaleattorney Com Legit

Houses For Sale On Back Taxes