All Categories

Featured

Table of Contents

These financial investments can have higher prices of return, better diversity, and lots of other attributes that aid build wide range, and most significantly, build riches in a much shorter period. One of the easiest instances of the advantage of being an accredited capitalist is having the ability to buy hedge funds. Hedge funds are largely just obtainable to certified financiers due to the fact that they call for high minimum investment amounts and can have higher associated threats but their returns can be phenomenal.

There are additionally cons to being a recognized capitalist that associate with the financial investments themselves. A lot of investments that call for a private to be an accredited investor featured high threat (accredited investor investment networks). The strategies used by numerous funds featured a higher danger in order to attain the goal of beating the market

Merely transferring a couple of hundred or a few thousand bucks into an investment will certainly refrain. Approved financiers will have to commit to a couple of hundred thousand or a few million bucks to take part in financial investments implied for certified capitalists. If your financial investment goes south, this is a great deal of cash to shed.

Premium Accredited Investor Syndication Deals for Wealth-Building Solutions

Performance fees can range in between 15% to 20%. One more disadvantage to being a recognized financier is the ability to access your financial investment funding.

Being an accredited capitalist comes with a whole lot of illiquidity. They can also ask to assess your: Financial institution and various other account statementsCredit reportW-2 or other incomes statementsTax returnsCredentials issued by the Financial Sector Regulatory Authority (FINRA), if any These can aid a firm identify both your economic certifications and your sophistication as a capitalist, both of which can impact your condition as an approved investor.

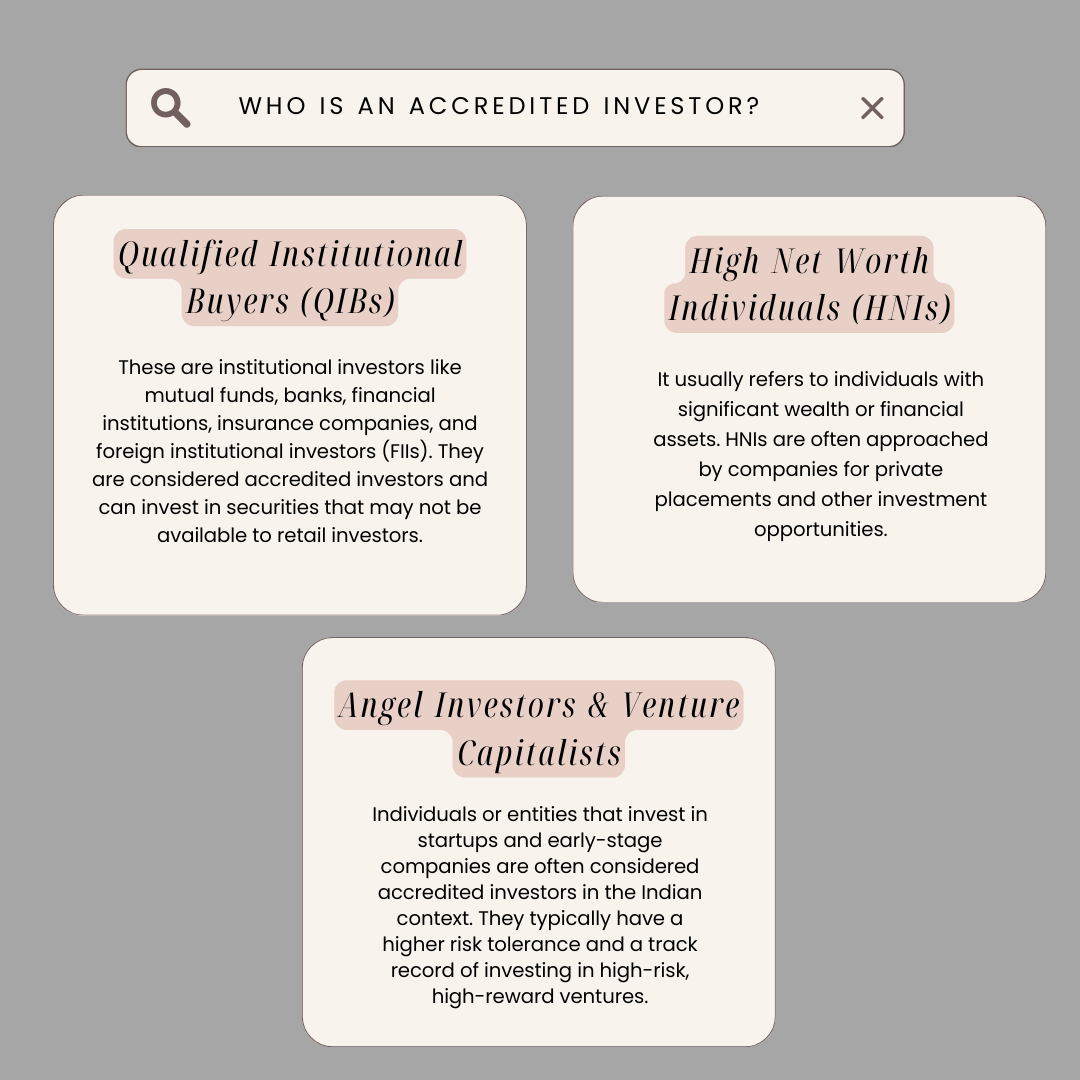

A financial investment vehicle, such as a fund, would have to identify that you qualify as a certified investor. The benefits of being an approved financier consist of access to special investment possibilities not available to non-accredited investors, high returns, and boosted diversity in your profile.

Innovative Exclusive Deals For Accredited Investors

In particular areas, non-accredited investors also deserve to rescission. What this suggests is that if an investor determines they desire to pull out their cash early, they can declare they were a non-accredited capitalist during and receive their money back. It's never a great concept to offer falsified records, such as fake tax obligation returns or financial statements to an investment vehicle simply to spend, and this might bring lawful trouble for you down the line.

That being claimed, each offer or each fund might have its own limitations and caps on financial investment quantities that they will approve from a financier. Approved capitalists are those that satisfy specific demands concerning revenue, certifications, or internet well worth.

Top Accredited Investor Real Estate Deals

Over the past a number of years, the certified investor meaning has been slammed on the basis that its single emphasis on an asset/income test has unfairly left out just about the richest individuals from lucrative investment possibilities. In reaction, the SEC started taking into consideration means to broaden this definition. After a substantial comment duration, the SEC adopted these amendments as a means both to capture individuals that have reliable, different indications of monetary refinement and to modernize specific outdated portions of the meaning.

The SEC's primary issue in its law of unregistered protections offerings is the security of those financiers that do not have a sufficient level of monetary class. This problem does not relate to experienced employees due to the fact that, by the nature of their placement, they have sufficient experience and accessibility to economic info to make educated investment choices.

The figuring out variable is whether a non-executive worker actually takes part in the personal financial investment firm's financial investments, which must be figured out on a case-by-case basis. The addition of educated workers to the recognized financier interpretation will also allow more staff members to purchase their employer without the personal investment firm risking its very own standing as an approved investor.

Popular Accredited Investor Alternative Investment Deals

Prior to the modifications, some exclusive investment firm took the chance of shedding their recognized capitalist status if they permitted their staff members to buy the firm's offerings. Under the amended interpretation, a majority of exclusive investment firm staff members will certainly now be eligible to spend. This not only develops an added source of resources for the exclusive investment firm, but likewise additional lines up the interests of the staff member with their company.

Presently, only people holding specific broker or monetary expert licenses ("Series 7, Collection 65, and Collection 82") certify under the meaning, however the amendments provide the SEC the ability to include additional certifications, classifications, or qualifications in the future. Specific kinds of entities have actually additionally been added to the definition.

The enhancement of LLCs is likely one of the most significant addition. When the meaning was last upgraded in 1989, LLCs were reasonably uncommon and were not consisted of as a qualified entity. Because that time, LLCs have become exceptionally prevalent, and the definition has been modernized to reflect this. Under the modifications, an LLC is taken into consideration an approved investor when (i) it has at the very least $5,000,000 in possessions and (ii) it has not been created only for the particular function of acquiring the securities used.

Specific household workplaces and their clients have actually been included to the meaning. A "household office" is an entity that is developed by a family to handle its possessions and offer its future. To make sure that these entities are covered by the definition, the amendments state that a household workplace will currently qualify as an accredited investor when it (i) handles at the very least $5,000,000 in properties, (ii) has not been created especially for the purpose of getting the used protections, and (iii) is routed by a person who has the economic class to evaluate the benefits and risks of the offering.

Reliable Exclusive Deals For Accredited Investors

The SEC asked for comments concerning whether the financial limits for the revenue and property examinations in the meaning ought to be readjusted. These thresholds have actually been in area since 1982 and have actually not been adapted to represent rising cost of living or other elements that have actually changed in the stepping in 38 years. However, the SEC eventually made a decision to leave the asset and earnings thresholds unmodified in the meantime. passive income for accredited investors.

Please allow us understand if we can be helpful. To review the original alert, please visit this site.

Table of Contents

Latest Posts

Back Taxes Homes For Sale

Taxsaleattorney Com Legit

Houses For Sale On Back Taxes

More

Latest Posts

Back Taxes Homes For Sale

Taxsaleattorney Com Legit

Houses For Sale On Back Taxes